From Time Tracking to Profit: Integrating Zoho Projects with Zoho Books

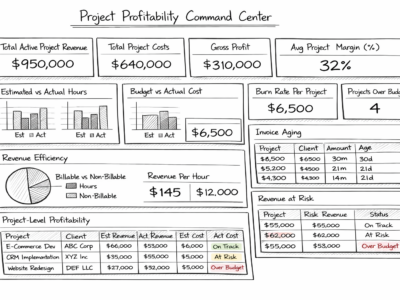

Most service-based businesses don’t struggle with effort. They struggle with visibility. Time is tracked in one system. Invoices are created in another. Profitability is reviewed in spreadsheets at …